As the popularity of NFTs reaches fever pitch, we look at some of the legal issues that may arise

Non-fungible tokens (NFTs) have become, well, fashionable. Ever since iridescence—a digital outfit created by Dapper Labs, The Fabricant and Johanna Kaskowska—was successfully auctioned on blockchain in 2019, well-known luxury fashion houses have started to embrace technology in exciting ways. Fast forward just two years, Gucci sold an NFT—a film based on its Aria collection. Then came Burberry, which designed digital accessories for the video game Blankos Block Party. Louis Vuitton, which had already designed a skin for a character on League of Legends, will be designing 30 NFTs that can be collected in a game called 200 Anecdotes. As the popularity of NFTs reaches fever pitch, we look at some of the legal issues that may arise.

Art imitating life

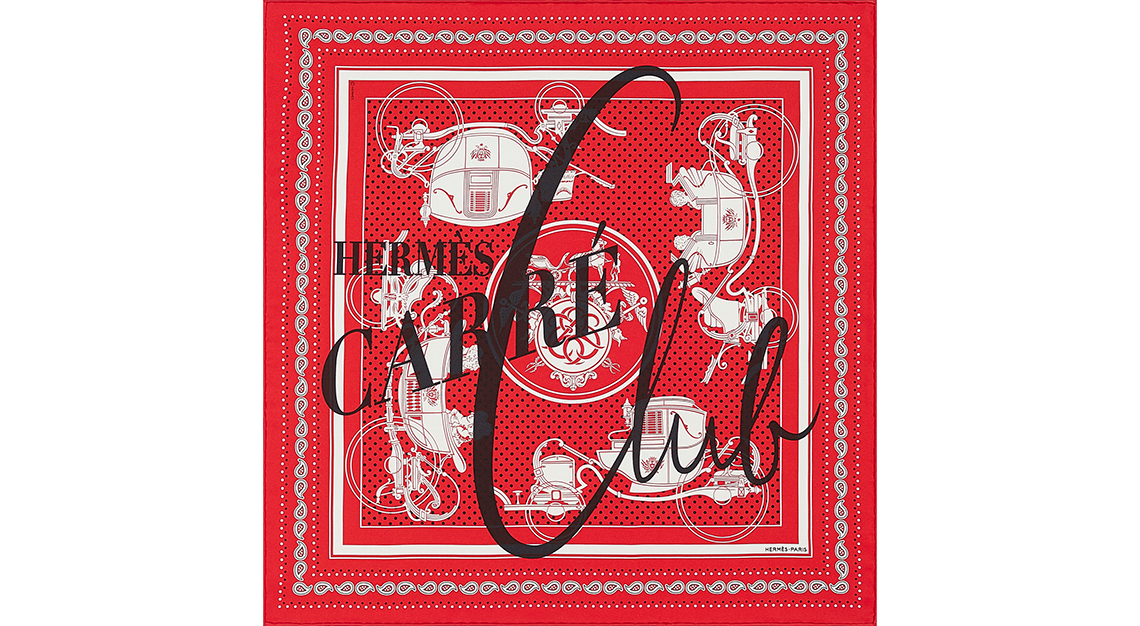

Just this year, Hermes sued Mason Rothschild, an artist who has been creating NFTs called “Metabirkins” that are furry, colourful depictions of Birkin bags. Metabirkin’s Instagram page boasts a following of about 20,000 followers and the most expensive NFT is worth almost double the most expensive “real life” Birkin.

Intellectual property claims of this sort are likely to increase as established brick-and-mortar companies stake their claims in the Metaverse. In another example, a site started offering 880 Olive Garden NFTs, each token being an image of a real-world Olive Garden location (a popular Italian chain in the United States). The owner of Olive Garden has issued takedown notices to those behind the site.

Some NFT creators claim to be doing it for artistic purposes. In a response posted on Mr Rothschild’s Instagram account, he likened his work to Andy Warhol’s depictions of Campbell’s soup cans. Others seek to question the status quo. Those behind the Olive Garden NFTs say they want to challenge the “ownership of Olive Garden franchises [that] has been dominated by the capricious whims of the fiat system.” Whatever the intention might be, it is easy to see how literally anyone behind a screen can do the same to any brand.

The that may legal issues arise

A key principle in intellectual property claims is showing that a consumer might be confused between the “genuine” and the “infringing” products. If these sites make clear that one is not purchasing anything associated with the “real” brand—as “Non-Fungible Olive Gardens” does—is that sufficient?

Yet another key element in such claims is showing a dilution of goodwill in the same market. If the “real” brand has not yet made a play for the metaverse market, would such an argument work? Should presence in the physical realm entitle a brand to claim monopoly in the virtual world?

Legal issues arise not only for businesses but for collectors. The legal status of NFTs remains unclear. Not all NFTs confer rights in the actual brand. In the case of the Olive Garden NFTs, one is not purchasing any photographs or any artwork—it is purely ownership over the token itself.

A collector could also get caught in the cross-fire. Opensea has banned an NFT series by Phunky Ape Yacht Club because it allegedly infringes the rights of the Bored Ape Yacht Club, which has its own (extremely valuable) NFTs.

Critics of the ban say that it is “anti-crypto” because it violates the tenet of decentralisation, touted as the cornerstone of the virtual economy. That argument has been extended even to Opensea’s decision to freeze transactions of some US$2.2 million worth of Bored Ape Yacht Club NFTs reported to have been stolen from its owner, Todd Kramer, in a phishing attack.

The future of NFTs

20 years ago, Cambridge law professor Kevin Gray wrote that contrary to popular belief, property does not require any physicality. Property is simply a bundle of legal rights can exist in “thin air” so long as the parties concerned and the law recognise those rights. Think high-rise strata titles.

Likewise, property is capable of existing in pixels. But the precise rights that may be asserted remain uncertain. In a de-centralised metaverse, NFTs would convey only those rights that the creator and the purchaser define for themselves. But for those rights to be enforceable against third parties, the platforms or the law representing community standards may need to step in.

How the physical and virtual worlds interact will also depend on whether the law views the metaverse as merely an extension of the physical world, or a different ecosystem requiring separate, if any, rules.

Paul Tan heads the commercial litigation practice at Clifford Chance’s foreign law alliance with Cavenagh Law LLP