It’s all in the risk action. Anyone can make money when investment markets boom, but who can protect you when they go ‘boom!’?

‘Don’t shoot the messenger’. The provenance of this phrase is uncertain, but may date back to ancient Greece, when emissaries bearing bad news were put to death upon reception.

It seems a strange code of conduct, and even stranger for the messenger doing the news bearing. Conscious of the fact that the dispatch may have been suboptimal, and knowing the fate that awaited him, he would have been forgiven for getting lost on his journey and heading to Mykonos to start a bed and breakfast and while away the remainder of his life recovering from retsina hangovers. There was, however, a sense of duty back in those days, and life was less valuable than it is today, according to market analysts.

Naysayers and harbingers of gloom and doom have been legion in the investment world since the Dutch East India Company offered a batch of shares at the start of the 17th century, in what can probably be described as the first ever IPO (Initial Public Offering). People have been analysing markets ever since, trying to predict movements predicated on news (good and bad) and buying or selling based on the information procured and the reliability thereof.

In 2005, Michael Burry, a hedge fund manager who was either a ‘visionary’ or ‘a sandwich short of a picnic’ depending on who you talked to, considered that the US housing market based on subprime loans was somewhat unstable, and created a credit default swap. He saw a pattern; recognised that there might be bad news on the horizon as far as mortgage-backed securities were concerned, and put his shirt (and those of his clients) on it.

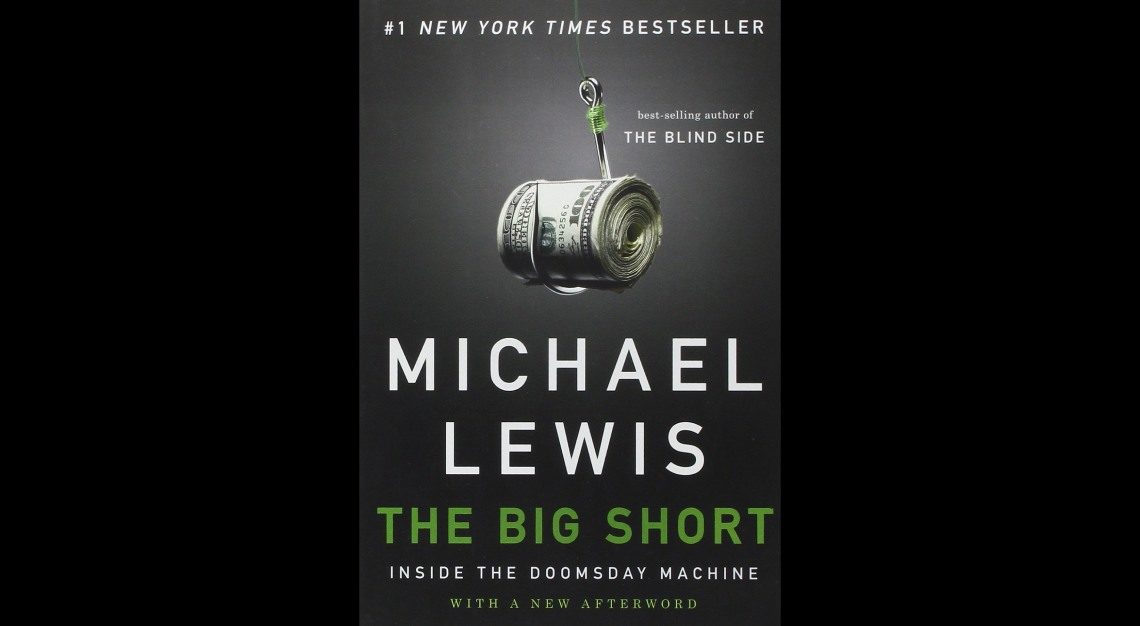

He was right. The market collapsed in 2008, as we all know, and his fund increased by 500 per cent with a near US$2.7 billion profit. Michael Lewis wrote a book about it in 2010, The Big Short: Inside the Doomsday Machine, and it was later made into a film with a stellar cast that included Christian Bale (as Burry), Steve Carell, Brad Pitt, Ryan Gosling and a whole bunch of other actors who probably didn’t understand the lines they were asked to say any better than the rest of us when we heard them. The investment world is complex, and the 2008 crash / correction (depending on your point of view) was suffused with mis- and lack of understanding, not to mention incompetence, negligence and, let’s not beat around the bush, fraud.

We’re all familiar with the concept of boom-slump cycles. They’re central to capitalist economics. But predicting patterns that others don’t see is something that everyone wishes they could do, because when the market is sick and ailing, there’s gold in them there ills.

This is something that has been recognised by a company called Convex Strategies in Singapore, who, like Noah (from the Old Testament) is building an ‘ark’ in preparation for a deluge.

According to the Bible, God told Noah that bad watery things were about to happen, and he should make plans. I’m not sure who Convex Strategies reference in their digital Rolodex, but their philosophy of insuring against bad things happening is one of which Noah, Mrs Noah, Shem, Ham and Japheth (and their wives, whose names are too difficult to spell) probably would have approved.

“One of my favourite quotes,” said David Dredge, one half of the dynamic duo behind Convex Strategies Pte Ltd, “is ‘risk isn’t what you think is going to happen, it’s what hurts if it happens.”

As we sit in the company’s conference room, I already realise that I am in over my head – as much as the human race was back in the day, with the exception of Noah, his immediate family, and a bunch of selected animals and their partners.

I’m hoping that there’s going to be an analogy that will help me better understand the opacity, and, thankfully, there is.

“Fiduciary asset managers,” Dredge offers, “are like the coach of a football team.”

Ah… football. This man speaks my language.

“The coach has managed to negotiate a ‘goals scored per game’ performance metric – that is, focused on short-term returns – while the team’s fans (the end-capital owners) really only care about the standings / league table at the end of the season. Those ‘standings’ relate to the terminal capital amount at retirement based on long-term compound returns, for example. So the incentives are flawed. Even the defensive players are incentivised to score goals, possibly to the detriment of their positional responsibilities, and the coach doesn’t even select a goalkeeper.”

Damn it. I was so close to understanding, and then the ‘goalkeeper’ reference entered the equation.

“We’re the goalkeeper,” said Dredge. “We’re here to ensure that the objectives of the fiduciary / coach and the capital owner / fans are properly aligned.”

And I get it. Or at least some of it. This is about portfolio insurance; taking the longer-term view, and taking fiduciary responsibility more seriously than all those fund managers out there (hedge and otherwise) who simply want to grab the glory by scoring ‘goals’ and enjoying the adulation of the crowd – or ‘temporarily happy investors’ if you prefer. They get paid, handsomely, with bonuses, for the goals they score, and don’t give a sparrow’s fart if they score six and their team concedes seven. They’re incentivised differently. They’re not encouraged to play a team game in which overall results are (and should be) more important than individual performances.

David Dredge and Convex Strategies say that they hold no view of markets, but only of risk. “It’s not the probability of an event,” says Dredge, “but rather the damage that an event could cause. We’re trying to protect people against uncertainty, and it comes down to the difference between exogenous and endogenous risk.”

And I’m lost again. “Exogenous is the likelihood of a lightning strike,” continues Dredge, patiently, indulgently. “While endogenous is the amount of dry grass and trees on the ground that could catch fire if and when the lightning strikes. We focus on the endogenous risk – that is, where the fire could do the most damage.”

Ironically perhaps, ‘buying’ insurance for such risk is less expensive when the likelihood of disaster is at its highest. If your house burns down, for example, and staying with the conflagration analogy, your future insurance premiums will go up. If your house hasn’t burnt down for a while, insurance will be cheap, despite the fact that it’s statistically (and in terms of probability) much more likely that there’s going to be a fire at some point, the more time elapses. This presents opportunities for Convex Strategies to short markets that others may not even have recognised, being too busy trying to make the most of fair winds and dry ground.

Dredge would like to write a book; several books in fact, but the first would probably be entitled Where’s My Money Gone? “We show our clients a simple chart that shows the impact on long-term compounded returns by short term arithmetic.”

I’m away with the fairies again, but not before concluding that this is all about making hay while the sun shines – doing well when everyone’s pulling into Boomtown – while mitigating the downside when Boomtown has been deserted and Slumpsville is offering very attractive rates on subprime mortgages. Targeting the tails, putting together a protection plan for when (possibly if, but almost certainly when) the deluge comes and no one who doesn’t have a lungful of water is looking at Noah as though he was a doofus anymore.

How Convex Strategies is going about this is as convoluted as many of the things Dredge speaks of, but like everything in life, there are options involved. Exact details will be a client privilege, I imagine, but Dredge and his team are not lacking when it comes to conviction.

“Strategies that target short-term returns with an emphasis on relative performance around the mean of the market,” concluded Dredge, clearly tempted to get back to talking about football but failing with the segue, “are destroyers of compounding. Investment strategies that have bounded upside participation, but correlate to the downside in bad markets should be avoided. They are killers when it comes to long-term expected returns.”

Got it. Now, tell me about those goalkeepers again, please. I promise not to shoot the messenger.